MAY 2020

Human Resources in China

The Technical Guide

53

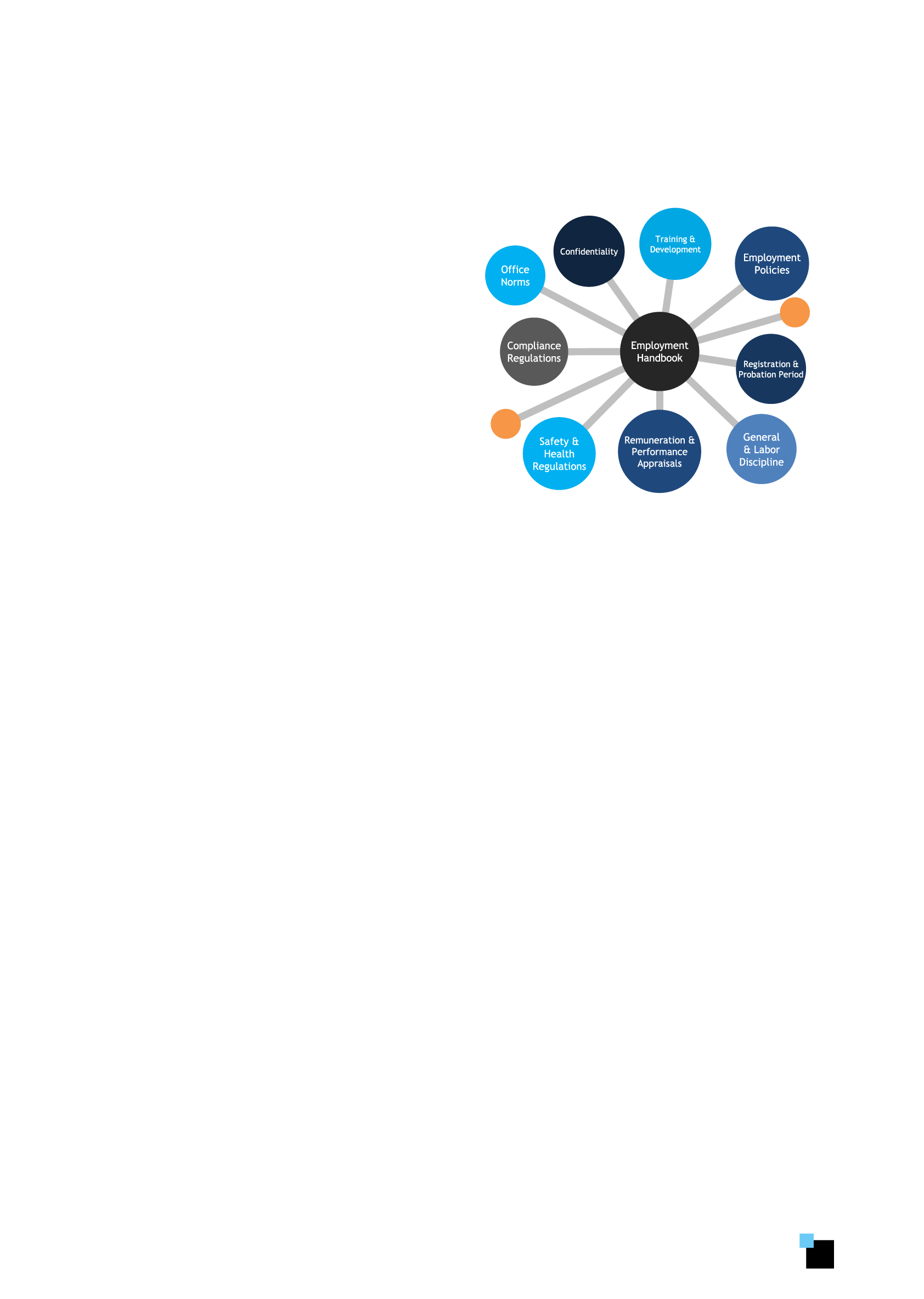

4.1 INTRODUCTION

The purpose of this chapter is to offer HR,

Compensation & Benefits professionals in China an

initial mapping of the different funds that go on top of

the gross salary to employees. Having already

reviewed social security and individual income tax in

China in the previous chapter, here we will look at

how the contributions to those funds are calculated;

and what is ultimately the total cost for an employer

when given a gross salary.

Because it is highly intertwined with the above, this

section will also cover the necessary calculations to

derive from the gross salary the actual net salary the

employee will take home. This is also highly relevant to

the employer since, in China, it is the employer’s

responsibility to calculate and withhold the payments

on the employee side for the employee’s individual

income tax, as well as the employee’s social security

monthly payments.

Definitions

Prior to addressing the mathematics and calculations

implicit in the purpose stated in the above introduction,

it is necessary to establish some definitions.

The following are concepts that we will be referring to

later on, and it is important to clarify them beforehand.

The social security and individual income tax law in

China have been extensively discussed in the previous

sections of this chapter.

Monthly BASE salary: The fixed amount the employer

guarantees the employee on a monthly basis. The

base salary has to be stated in the labor contract.

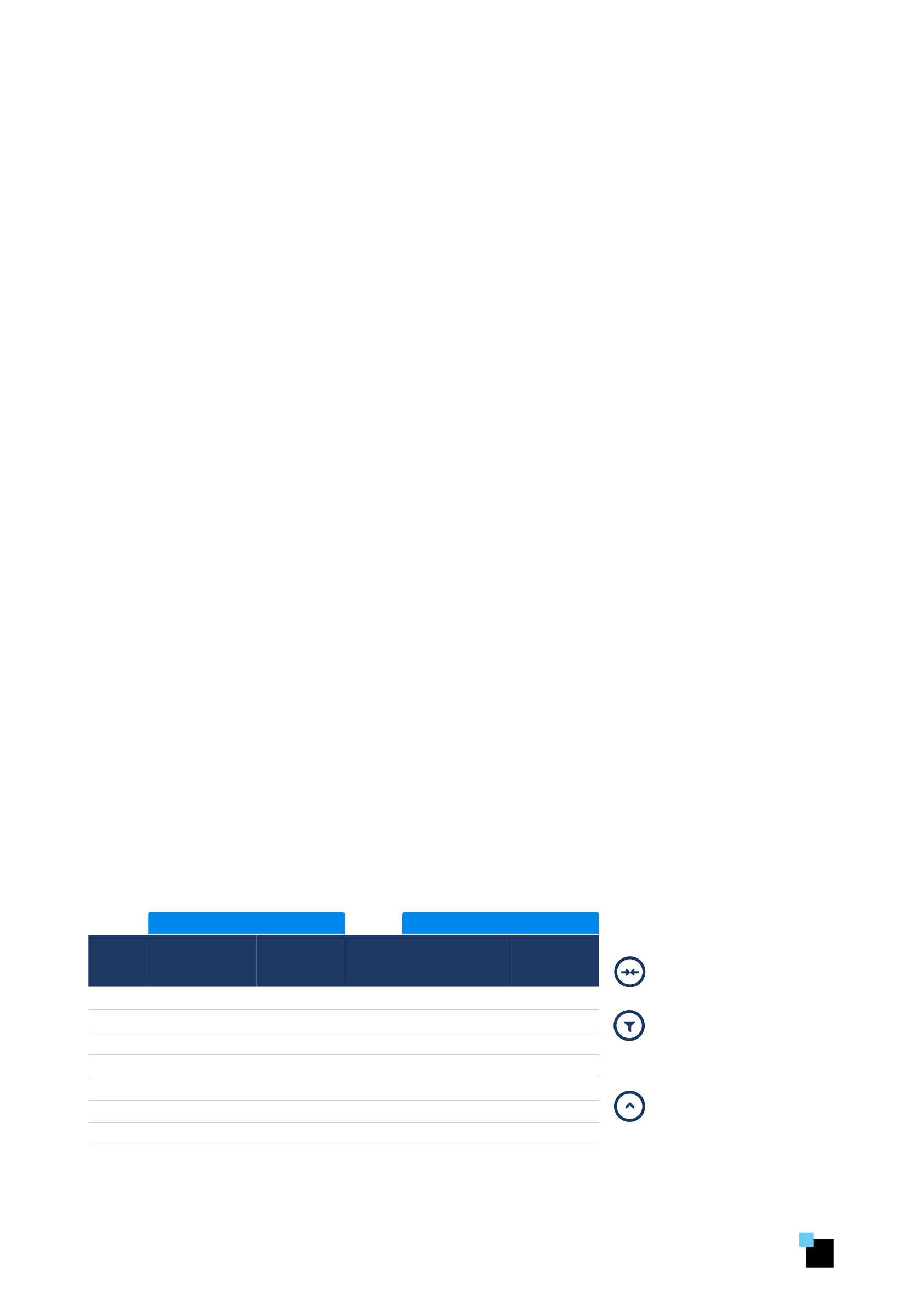

Monthly GROSS salary: Adding to the base salary, an

employer might offer an employee fringe benefits such

as bonuses, allowances, or even stock. Employers

should be wary though about including such payments

in the labor contract, as this will make them legally

bound to pay them. In the labor contract provisions

can be stated that benefits will be paid if performance

is above a certain level of expectations and if the

business performs well.

Individual Income Tax (IIT): A progressive tax system

with tax rates ranging from 3 to 45 percent. An

employer is responsible for deducting IIT on salary

In China, it is the employer’s

responsibility to calculate and

withhold the payments on the

employee side for the

employee’s individual income

tax and social security monthly

payments.

income before paying a net amount to its employees.

Payments of IIT from other sources of income are the

responsibility of the individuals. For more on IIT, refer to

3.2 Individual Income Tax (IIT) Law in the previous

chapter.

Monthly NET salary: The monthly net salary is the

actual amount the employee will receive in his/her

pocket every month, after adding to the base salary

whichever allowances may apply, overtime pay, and

bonuses; and deducting the employee’s individual

income tax (IIT) and the portion of the mandatory

social benefits payable by the employee.

This is, first and foremost, an employee-relevant

definition. However, for the reasons already explained

in the introduction, the monthly net salary is also highly

relevant to the employer.

All Chinese employees and employers are required to

contribute to social security on a monthly basis. For

more details on social security contributions from part-

time employees, see page 44.

Monthly TOTAL employer cost: This is an employer-

relevant definition. The addition of the base salary,

allowances, bonuses, non-mandatory benefits (i.e.,

non-mandatory housing fund, non-mandatory pension

plans), and the employer’s portion of the mandatory

social benefits results in the Monthly TOTAL employer

cost.

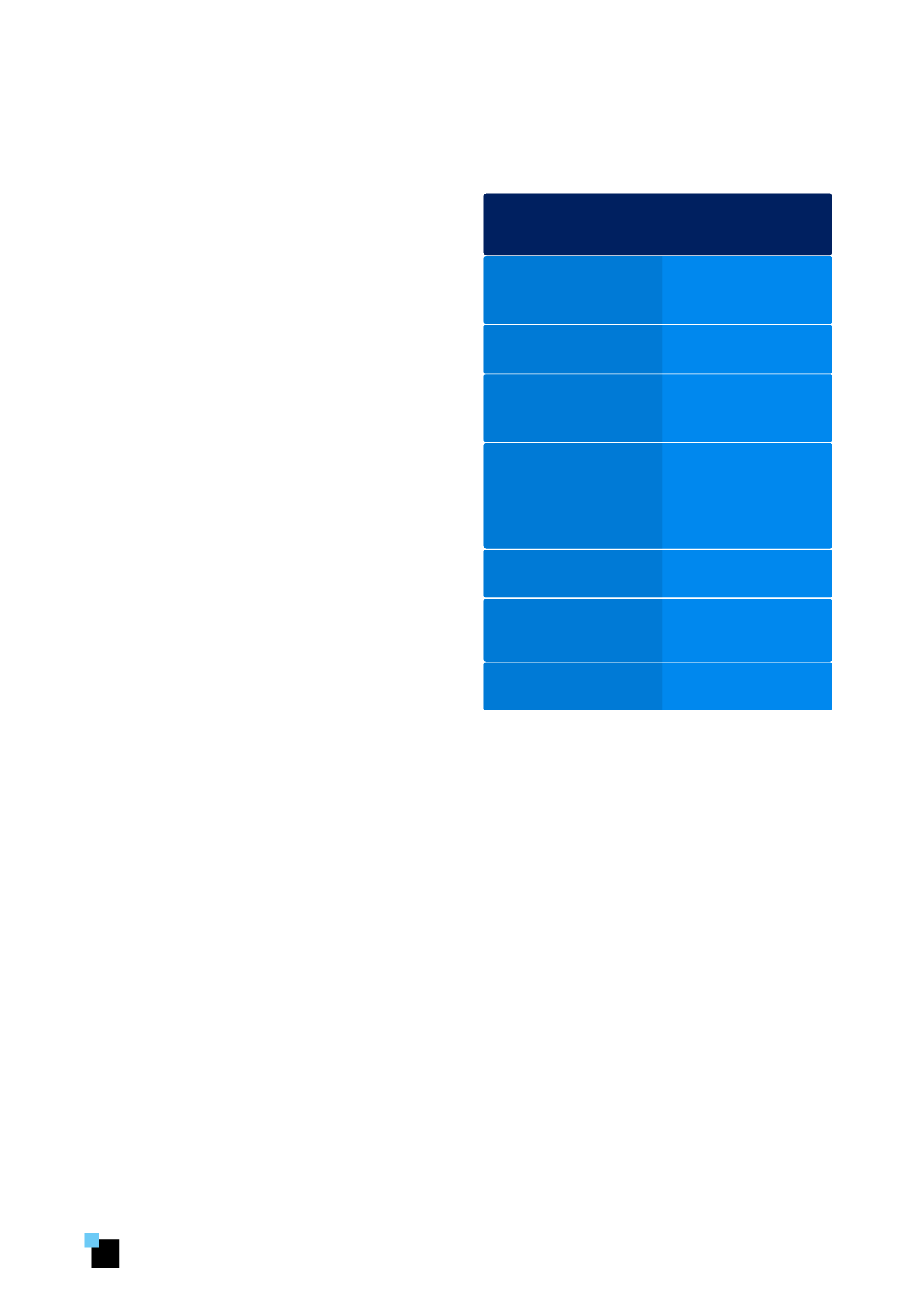

Mandatory social benefits (social insurance and

housing fund): for a thorough review of the different

funds that constitute the social security in China see 3.1

Social Security in China in the previous chapter.